News and updates from the Washington State Department of Financial Institutions.

Fall 2023 Newsletter Printer Friendly Version

Message from Director Clark: Carrying Out Our Mission

DFI Director Charlie Clark

In our Spring newsletter, a significant focus was on the out-of-state bank failures earlier this year, including the closures of Silicon Valley Bank and Signature Bank in March followed by First Republic Bank in the beginning of May. For many, these failures highlighted some important concepts. These concepts that were suddenly being discussed on the nightly news included such things as capital, liquidity, interest rate risk, FDIC insurance, NCUA insurance, and uninsured deposits. Another important concept highlighted by these recent developments has been the importance of regulation.

It is critical that the public has confidence in our financial institutions given the essential role that they play in making life better for those who live in Washington. Whether it is helping folks get on their feet with their first savings or checking account, offering financing for a car, home or business, transferring funds to a relative, or offering options for investing, these products and services are essential to both the financial health of Washingtonians and to a vibrant economy.

While the foregoing list is just a small sample of the financial products and services our regulated individuals and companies offer, the public has confidence in our financial institutions in part because our agency is committed to robustly regulating to ensure compliance with our laws.

In fact, day-in and day-out our dedicated team is carrying out our mission which is: “We protect consumers and advance the financial health of Washington State by providing fair regulation of financial services and educating consumers to make informed financial decisions.”

So, what does regulation entail? To begin with, we carefully review applications for new charters or licenses to ensure that the applicants meet, in most cases, significant licensing standards set forth in our statutes and rules. Once licensed, we examine our institutions to ensure compliance with the law. Our goal is to help our institutions follow the law and have strong compliance programs.

In the case of our banks and credit unions, we have robust examination standards and conduct reviews to help ensure the institutions are operating in a safe and sound manner to help avoid such failures that we saw earlier this year.

Lastly, we take enforcement action when needed to address consumer protection violations as well as more technical violations related to operating in an unsafe and unsound manner. While some of our enforcement actions are confidential and cannot be disclosed to the public, we have many actions that can be shared with the public. In fact, in addition to actions not reported more broadly, just since the last newsletter, our team issued the following enforcement actions against organizations we determined were causing harm to consumers:

- WA DFI Issues Action Against Coinbase, Citing Staking Rewards Program Violates State Securities Law

- WA DFI Joins $12.4 Million Settlement with Raymond James for Charging Unreasonable Commissions

- WA Among States to Recover $5.5 Million In Overcharges for Lear Capital Investors

- DFI Enters Multi-State Settlement with ACI Payments, Inc. for Unauthorized Transactions

Collectively, all of our regulatory efforts help ensure public confidence in our institutions and individuals offering financial products and services, and we take this obligation to provide fair regulation of financial services very seriously. So much so that we continue to try to improve how we regulate so that we are more effective.

In light of the bank failures earlier this year, both federal and state regulators are looking at whether adjustments need to be made related to how we regulate.

As Chair-Elect of the Conference of State Bank Regulators (CSBS), I have a seat at the table through CSBS with the leaders of the Federal Reserve, FDIC, and CFPB to help advance issues that are important to the states including Washington state.

One recent event in early October was the CSBS/Federal Reserve/FDIC Community Bank Research Conference at the St. Louis Federal Reserve Bank, where I engaged with other state and federal regulators to discuss emerging issues related to community banks. Serving as Chair-Elect of CSBS is an honor, but also an opportunity to continue to advocate for outcomes that make sense and align with our mission.

DFI Director Charlie Clark at the 2023 Community Banking Research Conference

DFI Honored for Efforts in Hiring and Supporting People with Disabilities

Kaylene Wright receiving award on behalf of the Agency

The Governor’s Committee on Disability Issues and Employment (GCDE) recently recognized DFI as the 2023 Employer of the Year for medium public/state agency employers. The GCDE promotes equality, opportunity, independence, and full participation in life for people with disabilities.

Tammy Stevens from OFM nominated DFI for our consistent efforts toward disability inclusion.

DFI’s workforce data related to hiring and retaining employees with disabilities was well above the second-highest agency’s data.

To accompany our nomination, DFI provided the committee with a write-up detailing the practices we used to achieve these high percentages. We also asked employees for testimonials and received three to include in our nomination packet.

This award is a great honor and is the second time DFI has received it.

Ali Higgs Becomes Acting Director of Consumer Services

Ali Higgs

This will be an Acting Director position that was effective September 20. Ali has served for several years on our Executive Team as Director of Regulatory and Legal Affairs, and previously had many years of service in our Division of Banks. With this appointment, the intention is to eventually open the position up for a formal recruitment for a permanent Division Director.

Along with this change, there are some shifts in leadership.

- Deborah Taellious will serve as the Acting Chief of Regulatory Affairs.

- Jack McClellan will serve as the Acting Regulatory Projects Coordinator.

- James Brusselback is returning to serve as the Acting Consumer Services Chief Enforcement Program Manager. James was in this office prior to leaving us in 2012 to work with the CFPB.

After long-time employee Cindy Fazio retired from DFI in September, these moves allowed us to maintain consistency and institutional knowledge.

The State of Community Bank Sentiment Index (CBSI)

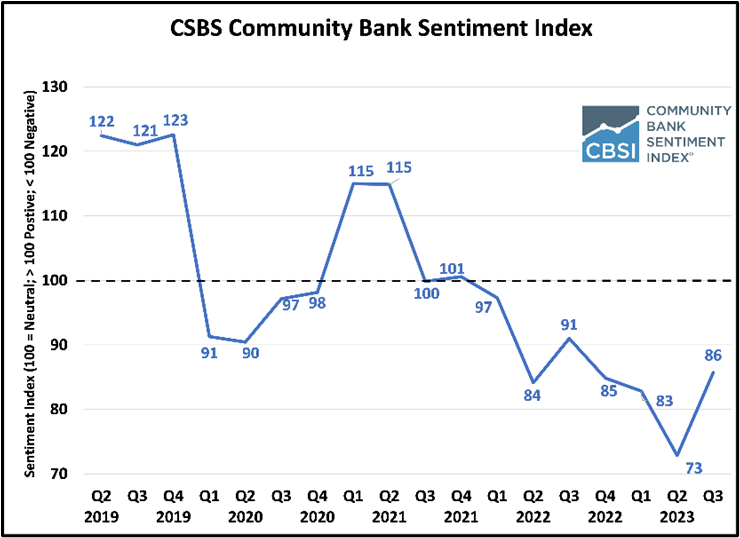

The CSBS third quarter 2023 CBSI indicates that community bankers remain pessimistic; however, the CBSI also increased for the first time in a year. All seven of the components that comprise the CBSI increased over the prior quarter. Additionally, fewer community bankers believe the U.S. economy is currently in a recession, from 87% compared to 95% last quarter.

Screen capture from CSBS. Anything above 100 indicates a positive sentiment, and anything below 100 indicates a negative sentiment.

Regulatory burden remains the area of most concern for community bankers, followed by monetary policy. Community bankers specifically cited the following as their top concerns looking ahead: cyberattacks, government regulation, the federal deficit, and the cost/availability of labor and inflation.

Conference Season for Banks

L to R: Trey Maust, Shannon Tushar, Kalin Bornemann

DFI Program Manager and Chief of Examinations for Banks, Shannon Tushar, presented on a panel titled “A Lawyer, Banker, and Regulator Walk into a BAAS… Banking as a Service Panel” at an annual convention. This panel was part of a joint conference hosted by several state’s banking trade groups, including the Washington Bankers Association.

DFI Offering Four-Day Financial Leadership Workshop for Students and Young Adults (over 18)

DFI is working with depository associations to offer a four-day financial leadership program on June 17-21, 2024, in Bellevue, WA. The program will highlight positions in banks, credit unions, and regulatory roles. Attendees will also be matched up one-on-one with a mentor, providing a direct connection into the financial industry.

Next Generation Leaders Financial Workshop

Wire Fraud Alert and Recommendations

With cybercrimes becoming more sophisticated in nature, an additional risk is created for both financial institutions and consumers.

The Division of Credit Unions issued Bulletin B-23-03 (Wire Fraud Bulletin) on April 20, 2023.

This bulletin gives recommendations for credit unions and member customers on questions to ask to avoid being taken advantage of.

Washington State Residential Mortgage Market Trends

The Division of Consumer Services’ Examinations Unit monitors market statistics and trends in the residential loan origination and servicing sectors. Mortgage rates hit 20-year high levels during the third week of October at nearly pushing above 7.50 percent. December of 2000 was the last time rates were recorded this high per MBA and Freddie Mac historical data. The origination market is being driven by purchase transactions. The Seattle-Tacoma-Bellevue metropolitan area ranked 6th in Inventory of homes listed for sale amongst the top 10 metropolitan areas according to ICE Housing Price Index (formerly the Black Knight HPI) data.

In 2020 and 2021, the Division of Consumer Services saw record-breaking years by reported origination volume followed by a steep decline in 2022 and into the first quarter of 2023. While mortgage originations have been trending downward, loan servicing volumes have increased, and the non-depository servicing market has broken into the trillions in terms of total volume serviced. Consumer Loan Act licensees reported the following total Washington volumes:

| Category of loan type | 2020 | 2021 | 2022 |

|---|---|---|---|

| Mortgage Loans Made | $117.9 billion | $121.3 billion | $48.5 billion |

| Non-Mortgage Loans Made | $700.5 million | $1.3 billion | $1.04 billion |

| Reverse Mortgage Advances | $472.1 million | $749.8 million | $652.2 million |

| Loans Brokered (CLA) | $5.8 billion | $6.3 billion | $3.1 billion |

| Mortgage Loans Sub-Serviced | $94.8 trillion | $120.2 trillion | $122.9 trillion |

| Student Education Loans serviced | Null | $30.9 billion | $38.5 billion |

Source: Consumer Loan Act Annual Assessment Filings

Washington State remains strong in loan performance. According to ICE (formerly Black Knight), Washington State has the second lowest percentage of non-current loans in the nation at 1.8 percent. This means that Washington has the second lowest percentage of delinquent loans and loans in foreclosure as a percent of active loans compared to all other states nationwide. This is a good indicator that Washington consumers can pay their mortgages. Serious delinquencies (loans 90 or more days past due) have continued to improve nationally as well.

Reminder That Student Loan Servicing Repayment Began October 2023

Beginning March 20, 2020, the office of the Federal Student Aid began providing temporary relief on federal student education loans. Further extensions of federal student loan relief were terminated under the Fiscal Responsibility Act of 2023. Federal student loan interest resumed in October 2023.

Preparing for Student Loan Payments to Resume

2022 Payday Lending Report Published

DFI recently published the 2022 Payday Lending Report.

The reports contain statistics and trends for the payday lending industry in Washington.

Safeguards Rule Requiring Non-Depository Institutions to Report Security Breaches

The Federal Trade Commission (FTC) recently approved an amendment to the Safeguards Rule requiring all non-depository financial institutions to report security breaches involving the information of at least 500 customers. Notification to the FTC will be required on the first day the breach is discovered, and no later than 30 days after discovery of the breach. The breach notification requirement will become effective 180 days after the rule is published in the Federal Register.

In addition to complying with the Safeguards Rule, non-depository licensees are required to report all data breaches to the Department. Data breach reports from non-depository licensees should be emailed to csenforcecomplaints@dfi.wa.gov.

Note on Virtual Currency Activity

Multiple virtual currency companies filed for bankruptcy last year and the Division of Consumer Services’ Enforcement Unit has been actively engaging with these licensees to ensure that actions in the bankruptcy case comply with state money transmitter laws. The Division of Consumer Services and the Division of Securities have been working together to monitor the virtual currency space.

The Division of Consumer Services also participates in the Money Services Business Enforcement Action Taskforce, which is a multi-state effort to monitor the industry and engage with entities as needed to bring them into compliance with state money transmission laws.

The Division of Consumer Services is aware that activity involving virtual currency is continuously evolving and continues to work with licensees to review changes in business activities and monitor financial conditions to ensure Washington consumers are not detrimentally impacted.

FinTech Companies and Out-of-State Banks Inquiry Report

On September 1, 2023, DFI published a report regarding lending activity involving financial technology (fintech) companies that partner with out-of-state banks and credit unions.

FinTech Companies and Out-of-State Banks Inquiry Report

Securities Division Issues Action Against Coinbase and Raymond James

Coinbase

DFI issued an action against Coinbase Global, Inc. and Coinbase, Inc. for violations of securities laws and corresponding penalties in connection with Coinbase’s staking rewards program. This action is the result of a multi-state task force of ten state securities regulators led by California that also includes Alabama, Illinois, Kentucky, Maryland, New Jersey, South Carolina, Vermont, Washington, and Wisconsin.

Staking occurs when investors lock their crypto assets for a set period to help support the operation of a blockchain. In return, the investor is promised more cryptocurrency. Under Coinbase’s staking rewards program, investors deposit crypto assets with Coinbase, which then facilitates the staking of these assets on the blockchain. The program is offered to the general public and advertises a return of up to 6% on investments. Coinbase pools investors’ crypto assets and employs a team of engineers to operate staking validator nodes to generate staking rewards. Coinbase takes a cut of those profits before sharing them with investors.

DFI determined that Coinbase offered its staking rewards program accounts to Washington State residents without first registering to offer or sell these securities with Washington DFI, in violation of state securities laws. This action does not prohibit Coinbase from offering a staking rewards program, so long as it complies with Washington’s securities laws.

Raymond James

DFI has joined a multi-state settlement with Raymond James & Associates, Inc. and Raymond James Financial Services, Inc. (collectively, Raymond James), which will pay at least $8.2 million in refunds to clients, and $4.2 million in penalties and costs to the states, for charging unreasonable commissions on trades that harmed main street investors.

This settlement stems from a multi-state task force of six state securities regulators including Alabama, California, Illinois, Massachusetts, Montana, and Washington. The states conducted a coordinated investigation into Raymond James’ compensation practices and concluded that Raymond James charged excessive commissions on more than 270,000 low-principal amount equity transactions nationwide. Raymond James took a commission on these transactions in excess of 5% of the principal value, sometimes taking 100% of the proceeds from a customer’s sale. Over the past five years, Raymond James took more than $8,250,000 in excess commissions from investors. DFI found no evidence of fraudulent conduct by Raymond James, and Raymond James fully cooperated with the investigation. Raymond James neither admits nor denies the findings or conclusions of law as set forth in DFI’s order.

Securities Division Attended the North American Securities Administrators Association’s Investment Adviser Training

Photo from left to right: William Baldwin, Jason Hensley, Patrick Stickney, Quincy Carlos, Chris Goodsel, and Mark Kissler.

Draft Amendments to Broker-dealer and Salesperson Rules

The Securities Division has prepared a draft of amendments to Washington’s rules concerning broker-dealers and salespersons of broker-dealers. The draft rules would repeal the broker-dealer and salesperson rules at Chapters 460-20B WAC, 460-21B WAC, and 460-22B WAC and replace them with a new combined chapter provisionally titled Chapter 460-20C WAC.

The purpose of the amendments is to bring Washington’s rules up to date with federal rules, incorporate NASAA model rules, to accurately describe the application filing procedures and requirements for broker-dealers (including broker-dealers who are not members of FINRA), and add additional examples of unethical business practices, among other updates.

The Securities Division plans to survey broker-dealers that would be affected by draft rules to inform the preparation of a Small Business Economic Impact Statement (SBEIS). After the SBEIS is prepared, the next step will be to formally propose adoption of the draft rules and invite public comment. If you have questions about the draft rules or would like to obtain a copy, please contact Faith Anderson, Chief of Registration & Regulatory Affairs, at faith.anderson@dfi.wa.gov.

New Franchise Act Interpretive Statement on the Disclosure of Franchise Fees

On November 1, 2023, the Securities Division adopted a new interpretive Statement under the Franchise Investment Protection Act, Chapter 19.100 RCW, concerning the disclosure of franchise fees to prospective franchisees. The adoption of Franchise Act Interpretive Statement No. 9 responds to reports of franchisors charging fees to franchisees that were not disclosed in the Franchise Disclosure Document.

Franchise Act Interpretive Statement No. 9 explains a franchisor must disclose all fees, including prospective fees, to a prospective franchisee in the Franchise Disclosure Document prior to the execution of the franchise agreement or the receipt of any payment by the franchisor or any of its affiliates, and further explains that a franchisor cannot impose a fee, through the operations manual or otherwise, without pre-sale disclosure.

Please contact Timothy Varney by telephone at (360) 902-8785 or by email at timothy.varney@dfi.wa.gov with any questions.

Securities Whistleblower Award and Protection Act

Washington’s new Whistleblower Award and Protection Act went into effect on July 23, 2023. This new law allows DFI’s Securities Administrator to provide financial awards to whistleblowers who provide original information to the Securities Division that leads to successful enforcement action under the Securities Act. It also provides protections from retaliation and confidentiality. We are proud to be one of five states that have adopted these provisions for whistleblowers. Learn more at Whistleblower Award and Protection Act Frequently Asked Questions. You can find the text of the new legislation at RCW 21.40. To file a whistleblower complaint, you can use the Securities Division’s complaint form.

Investment Adviser Renewal Season is Coming

Renewal season is almost here. Renewal has two steps: (1) payment of annual renewal fees to the Investment Adviser Registration Depository (IARD), which must be received by the IARD no later than December 11, 2023; and (2) annual filing requirements, which are due within 90-120 days after the investment adviser’s fiscal year end (FYE).

2024 Renewal Calendar

| Action Item | Where/To Whom | Action Due Date |

|---|---|---|

| Pay renewal fees | IARD | December 11, 2023 |

| File Form ADV Parts 1 & 2 | IARD | 90 days after the Adviser’s FYE |

| Deliver or Offer Form ADV 2 | Clients | 120 days after the Adviser’s FYE |

| File GAAP Balance Sheet | Securities Division | 120 days after the Adviser’s FYE |

| File Fund Audit (Private Fund only) | Securities Division | 120 days after the Fund’s FYE |

Annual Renewal Fees

| Renewal | Fee | Amount |

|---|---|---|

| Investment Adviser | IARD System Fee | $0 |

| Investment Adviser | Washington State | $85 |

| Investment Adviser | Other Jurisdictions | Learn more |

| Investment Adviser Representative | IARD System Fee | $15 |

| Investment Adviser Representative | Washington State | $30 |

| Investment Adviser Representative | Other Jurisdictions | Learn more |

Unless otherwise requested, the Securities Division does not send any renewal and filing notices via hard copy; they will continue to send communication via email and post notices on DFI’s website. If you have any questions or would like to receive hard copy notices, please email IALicensing@dfi.wa.gov or call (360) 902-8815.

Financial Education and Spanish Outreach

We are happy to welcome Nathan Spiecker as our new Financial Education and Spanish Language Outreach Coordinator. Nathan recently moved to Washington after spending four years working with a small community-focused organization in Nicaragua. He is fluent in Spanish and also speaks Norwegian and Albanian!

Spiecker’s first solo outreach event took him to College Place Elementary School in Lynnwood recently after an invitation from teacher Maestra Palacios. She shared this after his visit:

Nathan Spiecker

“Thank you Nathan Spiecker from WA Dept. of Financial Institutions (DFI) Communications & Financial Education Outreach. We raise our hands to the community, uplifting our students; guest readers have been reading in Spanish, such a luxury, and have diverse backgrounds.”

Outreach requests continue to increase – and are welcomed!

The team’s events just since June have taken them to Bothell High School, Surprise Lake Middle School, Mercy Housing in Tacoma, Stillwaters Estates (twice!) in Centralia, Toledo Senior Center, The Hub Senior Center in Belfair, the Latino Expo in Edmonds, Spokane for the Washington Association for Career and Technical Education teacher conference, New Holly Gathering Hall in Seattle for the HUD BIPOC Homeownership House Party, and Chehalis Tribal Community Center for a Financial Freedom Fair.

We continue to offer virtual presentations as well and have committed to quarterly lunch and learns with our colleagues at Labor and Industries.

Diversity, Equity, and Inclusion

DFI is continuing to grow our diversity, equity, and inclusion webpage. Last month we added videos to help people better understand who we are, what we value, and how to work with us. We added some new sections, including a DFI DEI events page. This came from DFI-hosted community and industry meetings, where attendees asked us to do more events to connect community and industry around current needs. DFI has also highlighted our co-creation efforts, pro-equity anti-racism work, government to government, diverse workforce, and supplier diversity.