| License Types | As of March 2024 | As of March 2023 |

|---|---|---|

| Mortgage Broker Main Office | 365 | 371 |

| Mortgage Broker Branch Office | 170 | 210 |

| Consumer Loan Main Office | 1,019 | 983 |

| Consumer Loan Branch Office | 2,797 | 3,197 |

| MLOs – Active | 17,012 | 18,808 |

| MLOs – Inactive | 2,797 | 3,825 |

Q1 MCR Filing Deadline Extended

The Department issued interim guidance extending the filing deadline for the Q1 Mortgage Call Report (MCR) from May 15 to July 15. This is due to the release of the new Form Version 6 (FV6) of the MCR. Additional interim guidance was issued to Consumer Loan licensees regarding the requirement to file the State Specific Supplemental Form (SSSF).

Interim Guidance on 60-day Grace Period for Q1 MCR

Interim Guidance on State Specific Supplemental Form (SSSF)

Mortgage Call Report Form Version 6

Keeping Surety Bond Compliance

A reminder to Mortgage Broker and Consumer Loan licensees that now is the time to review and adjust the amount of your surety bond to ensure compliance. The bond amount is based on prior year activity in Washington and must be updated annually. The deadline for adjusting the bond amount depends on the license held. Mortgage Brokers must make the adjustment by March 31 and Consumer Loan licensees by March 1. Adjusting your bond amount is done by the surety provider via a rider issued in NMLS which is marked “ready” by the licensee in NMLS.

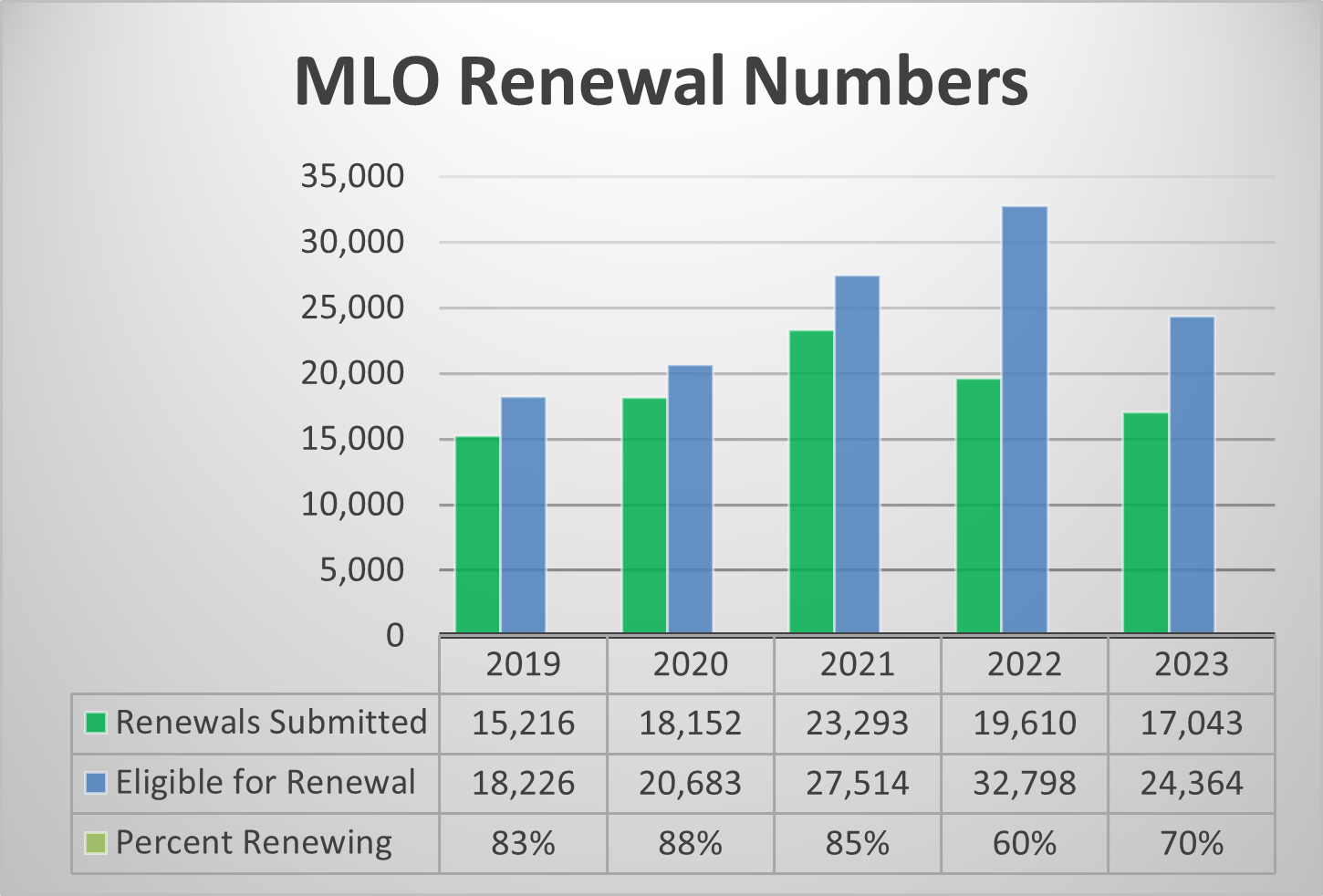

Renewals Recap

With the close of another renewal period, here is a look at the renewal numbers, specifically for MLOs. Going into the renewal period, the number of MLOs eligible to renew decreased by about 8,000. This is due to a high number of MLOs not renewing last renewal cycle. By December 31, more than 17,000 MLOs requested renewal or 70% of those eligible. As is typical, most of the MLOs who didn’t renew for 2024 are those holding an inactive license.

The Department continues to use auto-renewal for MLOs. This allows MLO renewals which meet certain criteria to renew after a set amount of days. As of 12/31, the Department had completed more than 99% of renewals submitted and reviewed all requests submitted by the system close on 12/31.

Mortgage Broker Forum

The Mortgage Broker Forum was held February 5. Attendees got a quick look at licensee numbers as well as an update from Exams before a question and answer on pre-submitted topics.

If you are a Mortgage Broker licensee and are interested in getting involved with the Mortgage Broker Forum, contact Jeff Nance at Jeff@northshorecf.com.

Mortgage Industry Webinar

The Department’s Mortgage Industry Webinar is scheduled for April 24 at 11am (Pacific). The webinar is for all mortgage licensees. Hear updates from the Department’s licensing, examinations, and enforcement units.

Visit the Mortgage Industry Webinar webpage for information on the upcoming meeting as well as notes and recordings of previous meetings.