Mortgage Industry Update

Licensing Updates

| License Types | As of February 2021 | As of February 2020 |

| Mortgage Broker Main Office | 326 | 310 |

| Mortgage Broker Branch Office | 176 | 232 |

| Consumer Loan Main Office | 772 | 711 |

| Consumer Loan Branch Office | 3,142 | 2,648 |

| MLOs - Active | 19,519 | 15,463 |

| MLOs - Inactive | 1,017 | 1,088 |

2020 Consumer Loan Annual Assessment Online Filing System Available

It’s time for Consumer Loan licensees to file their 2020 Consumer Loan Annual Assessment. All filings and payments must be completed by March 1. To get started, visit the Consumer Loan Annual Assessment page for important information. All Consumer Loan companies who held a license in 2020 must file, even if the company conducted no Washington business.

Important Information includes:

- The Student Education Loan Servicing (SELS) annual assessment filing will be filed and paid through the Online Filing System and will not be collected outside of the Online Assessment Filing System as in the prior year.

- The assessment on residential mortgage loans in portfolio on December 31, 2019, will be temporarily waived for the calendar year 2020 activity.

- Residential mortgage loans brokered, purchased, and made during the 2020 calendar year will be assessed.

After completing the annual assessment filing, licensees must adjust their surety bond amount based on the loan volume reported. See WAC 208-620-320 for bond calculations.

Email csexamsunit@dfi.wa.gov with any questions. Support available Monday - Friday 8:00-4:30 PST.

Additional Reporting Deadlines

Other upcoming reporting deadlines for Mortgage Broker and Consumer Loan licensees include:

-

April 1 – Financial Conditions filing deadline

- Applies to licensees filing the Standard MCR and who have a fiscal year end of 12/31

Application Volume Rises Rapidly

2020 marked an incredibly busy year for the Mortgage Licensing staff. Shortly after the start of the year, the number of applications filed started increasing for company, branches and especially Mortgage Loan Originators (MLOs). By the end of the year, Mortgage Broker and Consumer Loan company applications increased by more than 30 over last year and branch applications increased by more than 200. The real surge happened with MLOs where the number of applications increased by more than 3,400.

The increase in applications during 2020 are likely caused by many factors. The implementation of Temporary Authority to Operate in November 2019 caused at least some of the increase among MLOs. For Washington, the number of MLO applications qualifying for Temporary Authority has averaged at about 40% of the applications filed.

As licensees assist their MLOs in filing applications, here are some sections of the application to double check before submission in order to avoid delays in processing:

- Legal Name – Make sure the name on the MLO’s NMLS record matches the legal name on their uploaded documents (passport or birth certificate). If the MLO does not have a full middle name, ensure they upload a legal document to support their legal name.

- Document Uploads – Review the MLO’s document uploads to ensure proper placement of documents. Documents are often misplaced in the Legal Name/Status Documentation section. The only items in this section should be related to the MLO’s legal name or citizenship status.

- Duplicate Disclosure Explanations – Verify the MLO has a single disclosure explanation for each disclosure event. When asked to add additional information or documents to a disclosure explanation, the MLO should edit the current explanation and not add a new entry.

As a reminder, the Department offers expedited MLO application processing for military members, veterans, spouses, and dependents. Review the MLO new application checklist for details.

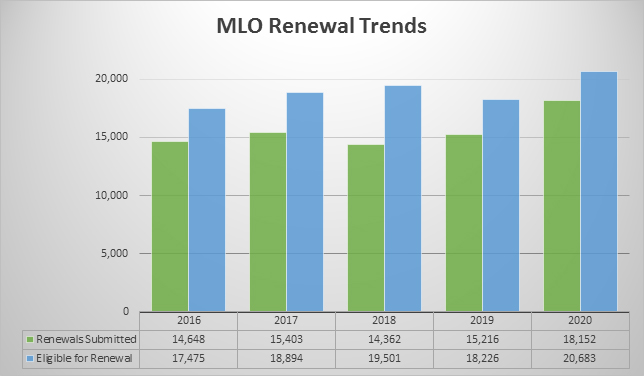

Renewals Recap

With the on-time renewal period completed, here is a look at the renewal numbers for MLOs. As expected with the application surge in 2020, the number of MLOs eligible for renewal increased by more than 2,000. The number of MLOs who submitted for renewal also increased by nearly 3,000.

The Department again used the auto-renewal functionality for MLOs. This allows MLO renewals which meet certain criteria to renew after a set amount of days. As of 12/31, the Department had completed 99% of renewals submitted and reviewed all requests submitted by 9pm on 12/31.

As a reminder, licensees have until the end of February to submit a late renewal request so the number of licensees submitting for renewal will change.

Mortgage Broker Forum

The twice-yearly Mortgage Broker Forum meeting will be held in March. Information on the date and how to attend will be provided via our GovDelivery system ahead of the event. For more information on the MB Forum, contact Jeff Lorsch, 206-200-5363, or financeman@evergreenstatemortgage.com.