Winter 2020 Newsletter

Mortgage Industry Update

Licensing Updates

| License Types | As of February 2020 | As of February 2019 |

| Mortgage Broker Main Office | 310 | 294 |

| Mortgage Broker Branch Office | 232 | 190 |

| Consumer Loan Main Office | 711 | 665 |

| Consumer Loan Branch Office | 2,648 | 2,510 |

| MLOs - Active | 15,463 | 13,907 |

| MLOs - Inactive | 1,088 | 1,344 |

Consumer Loan Annual Assessment Deadline Approaching

Less than a week until the deadline for Consumer Loan licensees to file the 2019 Annual Assessment Report. All filings and payments must be completed by March 1. The Consumer Loan Annual Assessment Report is filed through the Department’s online filing system. To get started, visit the Consumer Loan Annual Assessment page for important information.

Important Information includes:

-

Temporary fee reduction continues for 2019 assessment filing period.

- The assessment on the following categories of loans will be temporarily waived for the calendar year 2019: a) residential mortgage loans in portfolio on December 31, 2018; b) residential mortgage loans brokered in 2019; and c) residential mortgage loans purchased in 2019. Residential mortgage loans made during the 2019 calendar year will continue to be assessed.

- Student Education Loan Servicing (SELS) Annual Assessment will be collected separately from the online filing system. Please read important information regarding submission of SELS assessment data at our Student Loan Annual Assessment page.

- All Consumer Loan licensees must file, even if the company conducted no Washington business.

After completing the annual assessment filing, licensees must adjust their surety bond amount based on the loan volume reported. See WAC 208-620-320 for bond calculations.

Email csexamsunit@dfi.wa.gov with any questions. Support available Monday - Friday 8:00-4:30 PST.

Additional Reporting Deadlines

Other reporting deadlines are approaching for some Mortgage Broker and Consumer Loan licensees:

-

April 1 – Financial Conditions filing deadline

- Applies to licensees filing the Standard MCR and who have a fiscal year end of 12/31

Expedited Application Process for Military

In recognition of the tremendous sacrifices made by our military and their families, the Department offers expedited MLO application processing for military members, veterans, spouses, and dependents. To date, several qualified individuals completed the expedited process, typically within a few days.

Individuals who qualify should review the amended MLO New Application Checklist for specific directions. The process involves submitting the application through NMLS, including uploading certain documents, and then notifying the Department of the request for expedited processing.

DFI is committed to supporting our military members, especially those transitioning from military service, and spouses and dependents who often must relocate with their military family member. The expedited application processing supports Governor Inslee’s Executive Order 19-01 supporting veteran and military family transitions.

Renewals Recap

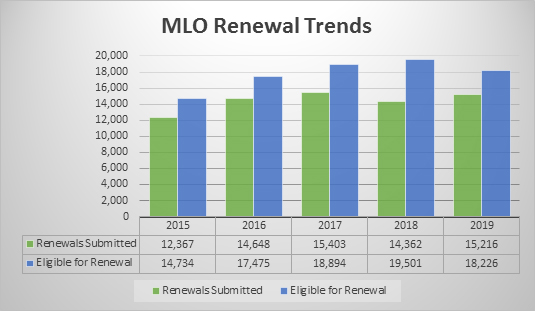

With the on-time renewal period completed, here is a look at some of the numbers. For the first time in recent years, the Department saw a drop in the number of licensees eligible to renew. This is directly tied to a lower number of MLOs renewing at the end of 2018.

The Department used the auto-renewal functionality for the first time for MLOs. This allows renewals which meet certain criteria to renew after a set amount of days. Preliminary information shows the turnaround time for processing MLO renewals fell by about 50% to 5.9 days.

As of the end of 2019, the number of MLOs who submitted for renewal increased over the previous year to more than 15,000. The majority of the MLOs who didn’t request renewal were inactive licensees which is fairly typical. As a reminder, licensees do have until the end of February to submit a late renewal request so the number of licensees submitting for renewal will change.

Working through the renewal requests, a few common errors appeared:

- Failure to Disclose: A significant number of MLOs had undisclosed bankruptcy, lien, judgment, foreclosure, or criminal history related items. Others had undisclosed regulatory action(s). MLOs have a 10-business day reporting requirement for changes to NMLS disclosure questions. WAC 208-620-710(27)

- Paid Lien and Judgments: Other MLOs previously disclosed a lien or judgment, then updated the disclosure and explanation to remove the item without providing evidence of its resolution. When removing a lien or judgment explanation, add a new Disclosure Explanation for a “No” response and upload a copy of the release or satisfaction.

- Outstanding License Items: Unresolved license items represented the most significant delay in renewal processing. Examples include: legal name issues, and employment and disclosure issues. Most outstanding license items were months old! Please respond immediately to license items.

We Want Newsletter Feedback:

We Want Newsletter Feedback: