Winter 2019 Newsletter

Mortgage Industry Update

Licensing Updates

| License Types | As of January 2019 | As of January 2018 |

| Mortgage Broker Main Office | 283 | 271 |

| Mortgage Broker Branch Office | 172 | 172 |

| Consumer Loan Main Office | 666 | 648 |

| Consumer Loan Branch Office | 2,472 | 2,471 |

| MLOs - Active | 13,821 | 15,164 |

| MLOs - Inactive | 1,004 | 1,580 |

Consumer Loan Annual Assessment - March 1 Deadline

It’s time for Consumer Loan licensees to file the 2018 Annual Assessment Report. The deadline to file is March 1. The Consumer Loan Annual Assessment Report is filed through the Department’s online filing system. To get started, visit the Consumer Loan Annual Assessment webpage for important information.

Changes to the online filing system include:

- New questions regarding Student Education Loan Servicers

- Residential Loan Servicing invoices are no longer billed separately - Payment will be due at the time of your assessment filing by the March 1, 2019 deadline

-

Temporary fee reduction:

- The assessment on the following categories of loans will be temporarily waived for the calendar year 2018: a) residential mortgage loans in portfolio on December 31, 2017; b) residential mortgage loans brokered in 2018; and c) residential mortgage loans purchased in 2018. Residential mortgage loans made during the 2018 calendar year will continue to be assessed.

- The online system now accepts CSV files for uploading your supporting loan list

All Consumer Loan licensees must file, even if the company conducted no Washington business in 2018. After completing the annual assessment filing, licensees must adjust their surety bond amount based on the loan volume reported. See WAC 208-620-320 for bond calculations.

Email csexamsunit@dfi.wa.gov with any questions.

Additional Reporting Deadlines

Other reporting deadlines are approaching for both Mortgage Broker and Consumer Loan licensees:

-

February 14 – Q4 MCR filing deadline

- Applies to all Mortgage Broker and Consumer Loan Licensees

-

April 1 – Financial Conditions filing deadline

- Applies to licensees filing the Standard MCR and who have a fiscal year end of 12/31

Renewals Recap

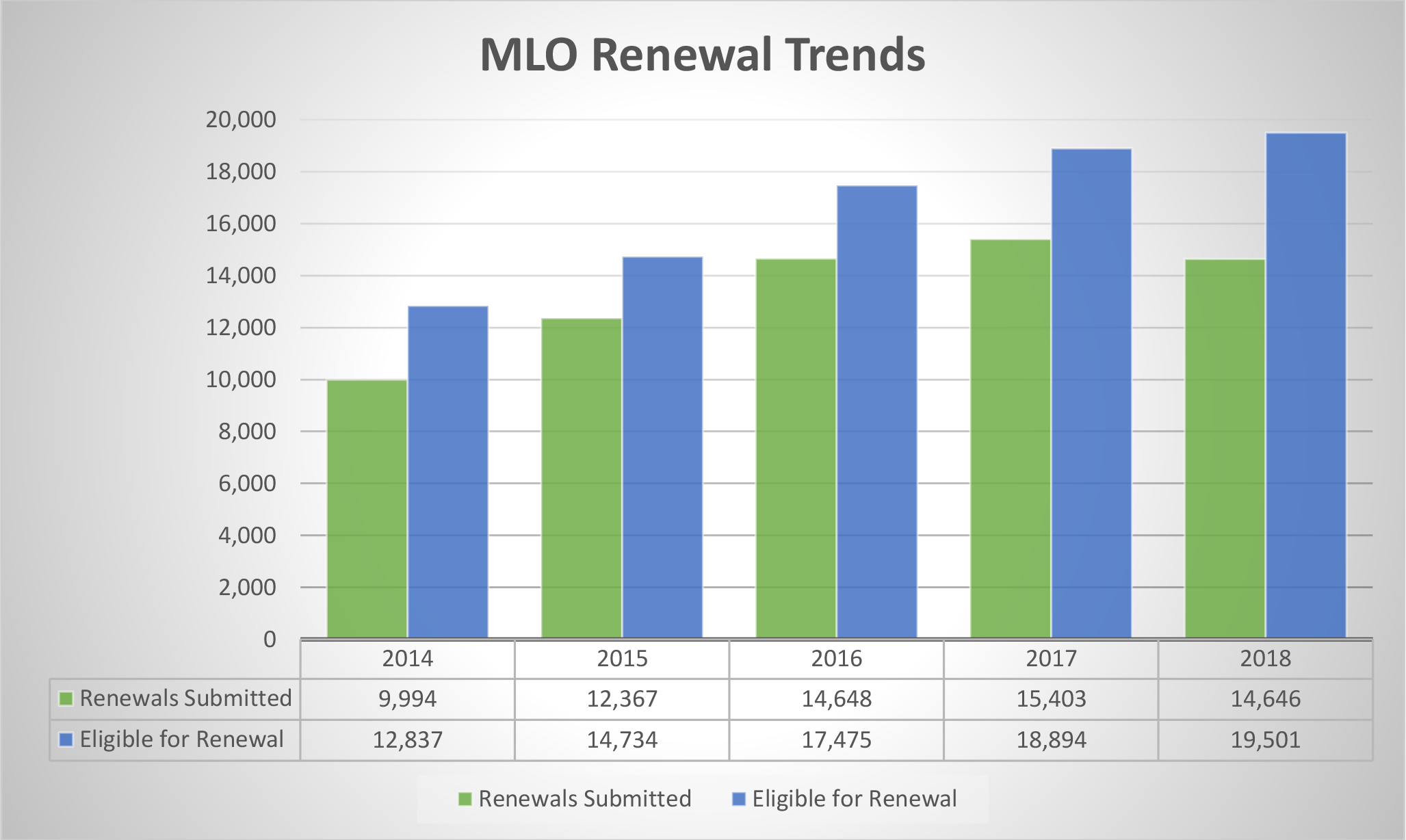

With the renewal period completed, here is a look at some of the numbers. The Department continues to see growth in the number of licensees eligible to renew. This year the number was 24,101. For MLOs specifically, more than 19,000 licensees could have renewed.

At the end of the year, the number of MLOs who actually renewed fell for the first time in at least the last 5 years. This decrease is consistent with the nationwide numbers. It appears the decrease is due, at least in part, to an increase in the number of inactive MLO licensees, many of whom did not renew. As a reminder, licensees do have until the end of February to submit a late renewal request so the number of licensees submitting for renewal will change.

Working through the renewal requests, a few common errors appeared:

- Failure to Disclose: A significant number of MLOs had undisclosed bankruptcy, lien, judgment or foreclosure. Others had undisclosed regulatory action(s). MLOs have a 10-business day reporting requirement for changes to NMLS disclosure questions. WAC 208-620-710(27)

- Paid Lien and Judgments: Other MLOs previously disclosed a lien or judgment, then updated the disclosure and explanation to remove the item without providing evidence of its resolution. When removing a lien or judgment explanation, add a new Disclosure Explanation for a “No” response and upload a copy of the release or satisfaction.

- Outstanding License Items: Unresolved license items represented the most significant delay in renewal processing. Examples include: legal name issues, and employment and disclosure issues. Most outstanding license items were months old! MLOs must respond immediately to license items.

We Want Newsletter Feedback:

We Want Newsletter Feedback: