Financial Education for Washington Residents

Learn about finances, find resources, and connect with local organizations.

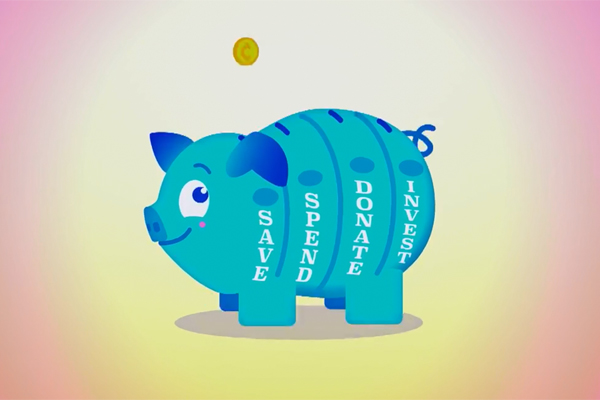

Free at home worksheets and activities for Washington students.

Network of individuals and organizations who support financial education.

The Office of the State Treasurer offers free interactive financial education modules covering a range of topics.